- Why St Paul

- About Us

- Admissions

- Academics

- Athletics

- Faith

- Community

- News & Events

Page 1 of 5

Now viewing articles posted in 2024.

2024 3rd and 4th Quarter Honor Roll

July 26th, 2024

Celebrating our students with the publishing of the 3rd and 4th quarter honor roll.2024 3rd Quarter2024 4th QuarterClass of 2024 Baccalaureate Mass

May 29th, 2024

Archbishop Christopher J. Coyne, was the principal celebrant at the Class of 2024 Baccalaureate Mass at St Gregory the Great Church in Bristol.

Commencement Exercises for Class of 2024

May 29th, 2024

Commencement exercises for the Class of 2024 were held on Friday, May 24 at 6:30 pm at the Cathedral of St. Joseph, Hartford.

Class of 2024 Valedictorian and Salutatorian

May 28th, 2024

Commencement exercises for the Class of 2024 were held on Friday, May 24 at 6:30 pm at the Cathedral of St. Joseph, Hartford.

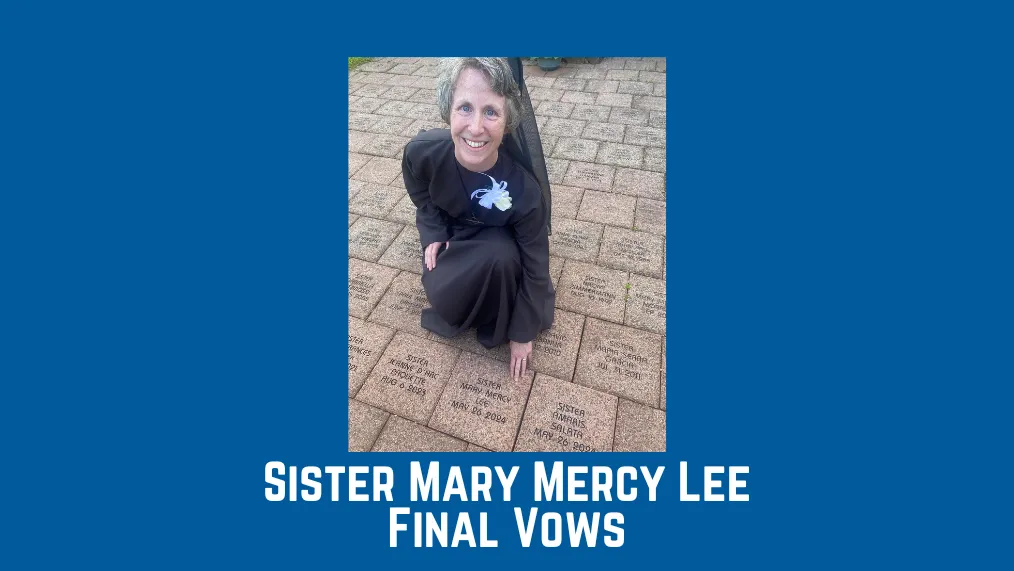

Sister Mary Mercy Lee Final Vows

May 28th, 2024

On May 26, family and friends joined on a beautiful Sunday afternoon, to witness Sister Mary Mercy Lee professing her final vows in a very crowded Chapel of...

Congratulations to Archbishop Coyne

May 1st, 2024

Our St. Paul Catholic High School family sends sincere congratulations to Archbishop Christopher J. Coyne, who...

Class of 2024 Summa Scholars

April 29th, 2024

Congratulations to our Class of 2024 Summa Scholars! This year’s Summa Scholars and the teachers they have honored are...

Emily Walker Scores 300th Goal

April 23rd, 2024

Congratulations to Emily Walker ’24 for scoring her 300th goal of her career. She led the Falcons with seven goals in a 15-9 victory over Watertown last week (4/15/24).

Posted in: Sport News, All News

Recent Articles

Page 1 of 5